21.08.2017

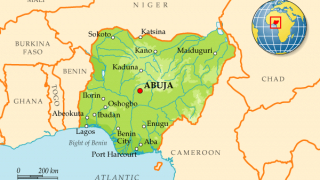

That Could Potentially Be Nigeria’s and Africa’s Next Socio-Security Challenge. Part I

14.10.2016

Speaking at a press briefing, the Russian Foreign Ministry's spokeswoman Maria Zakharova told that Washington sent instructions to its...

24.01.2020

The announcement by the Ivorian president - Alassane Ouattara - to discontinue the use of the CFA Franc by the eight out of the 15 member states of...

06.11.2016

Nigerian military are reported to have freed 85 people (most of them women and children) from the captivity of the radical Islamist group «Boko Haram...

08.09.2016

In-fighting broke out between Boko Haram militants after the ISIS group announced a new leader of its Nigerian affiliate, according to reports in the...

18.08.2016

Despite the persistent effort of the Greek Media to present the report issued by the Independent Evaluation Office on July 8th, which examines the...

26.07.2018

Appendix Two

ISLAMIC CONFERENCE: COMMUNIQUE (JOINTLY ISSUED BY THE ISLAMIC COUNCIL, LONDON; THE ORGANISATION OF ISLAMIC CONFERENCE, OIC; AND THE...

16.11.2016

Egypt's Court of Cassation has overturned a death sentence against the former president Mohamed Morsi and five members of the organization Muslim...

28.12.2016

Sambisa Forest was released from the terrorist group Boko Haram. About three thousand people have managed to come back home in northeast Nigeria....

18.01.2017

A Nigerian air force fighter jet on a mission against Boko Haram extremists mistakenly bombed a refugee camp on Tuesday, killing more than 100...

11.11.2016

Attacks will continue until the underlying issues of resource control, environmental degradation, and social welfare amongst others are addressed.

12.12.2016

Two young girls (7 and 8 years old) are reported to have carried out the attack on the market in Nigeria. Presumably, “Boko Haram”, or another...