Despite Fundamentals, Oil Surges Above $40

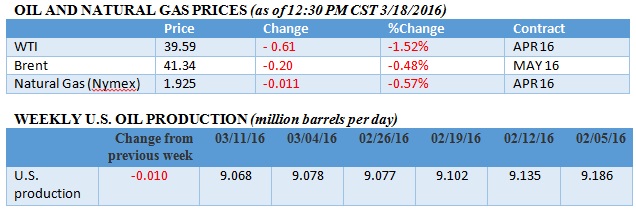

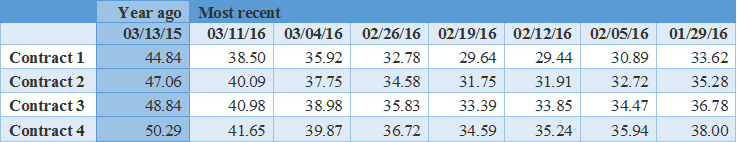

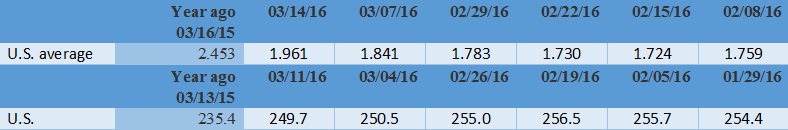

Oil prices are nearing their highs for 2016, with WTI topping $40 per barrel for the first time since the days surrounding the OPEC meeting in early December. The rally has been impressive – crude prices are up more than 50 percent since early February.

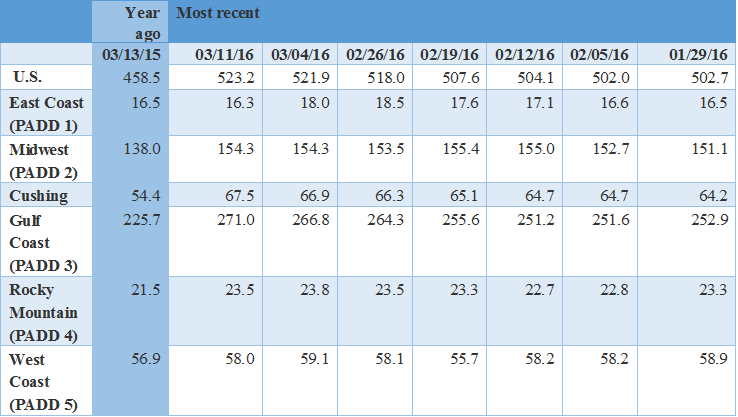

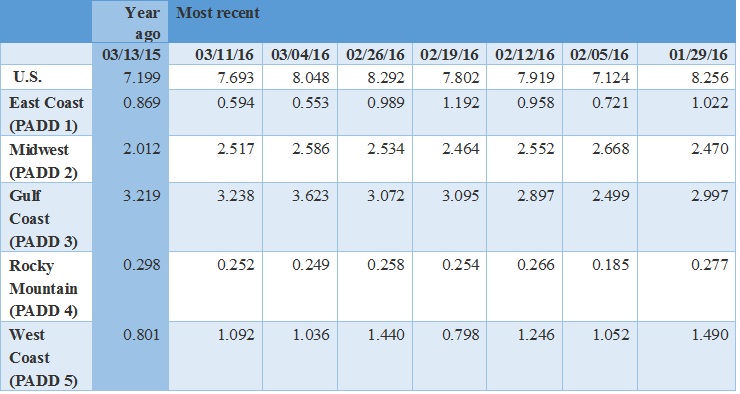

Is the rally for real? The fundamentals are still pretty poor, raising questions about the durability of the latest rally. Oil inventories are still massive (setting another record this week) and global supply continues to outstrip demand. The upward movements in prices are largely being driven by market sentiment and a weaker U.S. dollar over the past month and a half. A sustained rally in prices may not be here just yet, so there is a risk that prices retreat in the weeks ahead.

Brazil crisis explodes. The brewing political and economic crisis in Brazil exploded this week after President Dilma Rousseff appointed former President Luiz Inacio Lula da Silva to her cabinet, a move widely seen as an attempt to protect Lula from corruption charges that were levied against him only a week earlier. On March 13, more than 3 million people took to city streets around the country, protesting widespread corruption and demanding the removal of President Rousseff. The appointment of Lula set off another wave of protests on March 17.

The political firestorm is unfolding at a break neck pace, causing widespread confusion. Lula’s appointment was also intended to protect President Rousseff from her own impeachment proceedings, as Lula is a more popular figure. However, on March 17, a judge blocked the appointment of Lula, saying it was illegal. The outcome of the decision is not clear at this time. On the same day, an investigator looking into the Petrobras scandal published recordings of wiretapped conversations between Lula and President Rousseff, conversations in which the two apparently plotted Lula’s appointment to head off the corruption investigation. Rousseff portrayed the release of the tapes as the beginnings of a coup, while Rousseff’s opponents say they are solid proof of corruption. Protestors clashed violently with riot police in Brasilia, the country’s capital, late in the evening on March 17.

While the turmoil in the Brazil doesn’t necessarily affect the oil industry directly, at least as of now, the political crisis will only worsen the economic crisis. The highly indebted Petrobras, still suffering from the corruption investigation, has no scope to invest in new oil projects. On the other hand, the political crisis could add impetus to the Congress’ pending decision to open up the pre-salt oil fields to greater private sector control, both as a way of stimulating the economy and because Petrobras’ position continues to deteriorate.

UK cuts taxes on oil industry. The British government took further steps on March 16 to aid its struggling oil industry, scrapping the 35 percent petroleum tax and reducing another tax on profits from 20 to 10 percent. The North Sea oil industry has been suffering worse than most during the downturn in prices, due to the aging oilfields and expensive production costs. The industry widely praised the move.

New pipeline safety regulations. The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) finally released new proposed safety regulations on oil and gas pipelines, more than five years after the deadly San Bruno, California explosion, which killed eight people and sparked a call to overhaul regulations. The proposed rules will raise the bar on safety inspections of older oil and gas lines, particularly in populated areas. Industry groups welcomed the long-awaited proposal and said they would review the rules.

TransCanada to buy Columbia Pipeline for $10.2 billion. TransCanada (NYSE: TRP) announced its decision to purchase Houston-based Columbia Pipeline Group (NYSE: CPGX) for $10.2 billion while also taking on $2.8 billion in debt. Columbia Pipeline owns 15,000 miles of natural gas pipeline infrastructure across the United States, but a large portion of the assets are located in the Marcellus and Utica shales. The purchase is equivalent to $25.50 for Columbia’s shares, or a 32 percent premium. The move is seen by TransCanada as a way to knock off a rival – TransCanada has struggled to move oil and gas from Canada to the United States.

Saudi Aramco and Royal Dutch Shell split up. The state-owned Saudi Aramco and Royal Dutch Shell (NYSE: RDS.A) have decided to split up their joint venture Motiva Enterprises LLC. Motiva consists of three major refineries on the U.S. Gulf Coast, plus an array of fuel terminals. Aramco will take the Port Arthur refinery, the largest in the United States. Shell will assume control of the two other refineries, based in Louisiana. The joint venture was established in 1998, but the two companies have diverging interests and saw a breakup as the best path forward. Aramco is looking to spin off assets in some sort of public offering while Shell is looking to divest itself of some assets.

Renewables could save $4.2 trillion through 2030. A new report finds that if the world doubled its share of renewable energy to 36 percent by 2030, it could save $4.2 trillion for the global economy. The report from the International Renewable Energy Agency (IRENA) says that an aggressive ramp up in renewable energy installations not only makes economic sense, but doing so will be less expensive than not doing it.

Peabody Energy (NYSE: BTU) nearing bankruptcy. The world’s largest private sector coal company warned that it could go bankrupt as depressed coal prices and weak demand cut into the company’s revenues, while debt becomes increasingly difficult to service. Peabody failed to pay interest on two loans that came due, and a 30-day grace period has begun. The company will fall into default if it does not pay within 30 days. “We may not have sufficient liquidity to sustain operations and to continue as a going concern,” Peabody said wrote in an SEC filing. “We may need to voluntarily seek protection under chapter 11 of the U.S. bankruptcy code.”

Pacific Exploration & Production (TSE: PRE) looking at a buyout to avoid bankruptcy. The largest oil producer in Latin America, Pacific Exploration, is considering six buyout offers in order to avoid going bankrupt. Based in Bogota but also listed on the Toronto Stock Exchange, Pacific’s share price has collapsed by more than 95 percent in the last two years.